The VAT form is a huge benefit of being an American living in Germany under the Status of Forces Agreement (SOFA)! But there are a lot of things about it that people get wrong, and that can cause serious problems for your wallet.

So rather than create major headaches because of minor mistakes, check out our comprehensive guide to using VAT forms in Germany! Trust me – you’ll want to read the whole thing.

What is VAT?

Value Added Tax (VAT) is the equivalent of sales tax in the US. But in Germany (and the rest of Europe), the VAT is included in the sticker price.

So when you go to Edeka and the price tag says €3.49, you will pay €3.49 for it when you check out. The same goes for dining out, buying furniture, shopping for clothes, or anything in between!

It makes shopping SO MUCH EASIER than in the US, where you have to consider how much tax will be added onto the sticker price when you finally pay.

When you get your receipt, you can see the breakdown of tax and the actual price of the product. There are a couple VAT levels you’ll see: 19% and 7%. We’ll explain more about these in a bit.

What is a VAT Form?

A VAT form allows you to make purchases without paying the sales tax. The US has an agreement with Germany so that eligible US service members may be exempt from paying VAT.

But using the form isn’t a right. You can’t force a vendor to fill out the VAT form, and you can’t use a VAT form on every purchase.

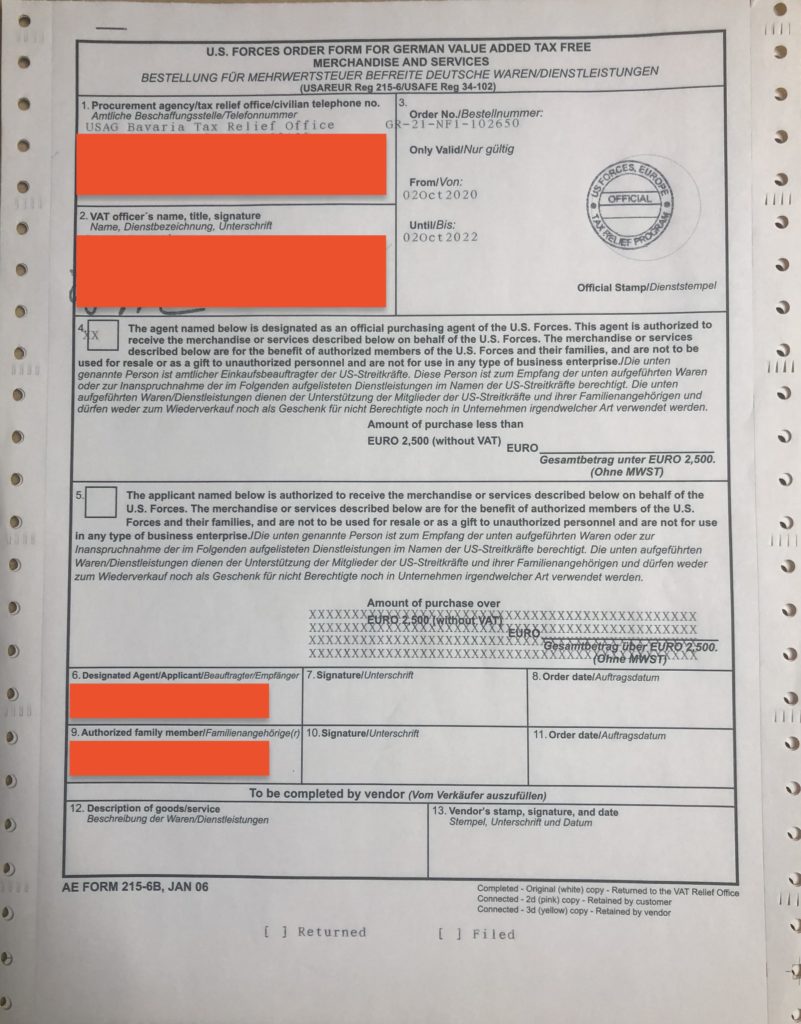

There are two types of forms: NF1 for purchases up to €2,499.99, and NF2 for purchases of €2,500 or more. You can only have 10 blank NF1 VAT forms at a time, whereas you can only have 1 blank NF2 VAT form at a time.

There’s also a price difference.

A/o Oct 1st, 2022:

– $10 for purchases less than €2500 (NF1)

– $100 for purchases €2500 or higher (NF2)

– $5 for reprints or mutilated/unused forms NF1 costs

The NF2 form has a few stipulations. We’ll explain more soon, but just know that you can only have a certain number of blank VAT forms at a time, and they do have expiration dates!

How to Use VAT Forms in Germany

First, the only people who can buy and use VAT forms are:

• DoD personnel

• anyone who has command sponsorship

So when your friends and family visit, you can’t give them your VAT forms! You also can’t use the VAT forms to make purchases for your German friends.

Anyone who qualifies can buy the forms at their local VAT office. The first time, you have to do it in person because you have to register. But after that, you can order by phone or email if you don’t want to go to the office. (Note: the email has to be sent from a .mil address.)

How do I use the VAT form?

Now that you have the VAT form, there are a few rules about how to use it.

First, you need to use the form before or during the purchase – not after. Either let the store attendant know before you start shopping, or tell them when you’re checking out. Not all employees will know what you’re talking about, so they may direct you to customer service.

The store employee or vendor will need to fill out their business name, describe the goods/services you’re buying, stamp it, and sign it. They give you the white and pink copies, and they keep the yellow copy and the Abwicklungsschein.

Then you return the white copy to the VAT office and keep the pink copy for your records. And that’s it!

Important: if you don’t return all of your forms to the VAT office, you cannot successfully out-process when you leave Germany.

So now that you have the basics of how to use a VAT form, what can you buy with it? As we mentioned earlier, there are two types of VAT that you can use an NF1 form for: 19% and 7%.

The 19% includes items like clothing, furniture, electronics, car accessories and parts, heating oil, restaurant bills, and minor home repairs. (We’ll explain more in a bit.) Purchases with 7% VAT may include basic grocery items, some magazines and books, and hotel stays.

How do I NOT use the VAT form?

Again, you cannot demand or force a vendor to accept your VAT forms in Germany. Outside of your garrison’s footprint, you won’t find many vendors who know about the program. And it’s rarely worth the time and effort to explain it in full.

If you use it for a hotel stay, we recommend telling them as soon as you check in. The front desk staff may need their managers to review and approve it, so your weekend holiday should be enough time.

A common misunderstanding about how to use a VAT form is whether you can use one form for multiple purchases from the same vendor. You can do that if:

• all the transactions occur within the same month

• the form is processed before the last day of that month

• the total amount doesn’t exceed €2499.99

For example, you will probably go to POCO or IKEA a few times when you first arrive. You make your first purchase on July 6, your second one on July 15, and your last one on July 21.

On your last visit to the store, take all of your receipts from that month. The store will then combine the total of the purchases and staple all the receipts to the single VAT form. All of that needs to be returned to the VAT office before July 31.

Another mistake is using the VAT form retroactively (with the exception of combining receipts, as noted above). If you forgot to bring your VAT form with you, then you’re out of luck. You can’t bring a VAT form the following day, week, or month to get the VAT back.

You also can’t break up a single purchase across multiple VAT forms. For example, if your receipt from IKEA comes to €3000, you can’t use one NF1 VAT form for €2000 and another for €1000.

Then there are some types of purchases you just can’t use a VAT form for:

• HBB or as an independent contractor (for revenue generating purposes)

• Buying new or used vehicles

• Buying or selling real estate

• Long term contracts (utilities, phone contracts)

If you’re still not sure whether you can use a form for something, check AER 215-6 for more details.

Get Our FREE Checklist! ✅

Common Mistakes When Using VAT Forms in Germany

If you understand the dos and don’ts, you probably won’t make any of these mistakes. But we still want to cover them since they’re…well, common mistakes!

Going along with what the vendor says

As we’ve mentioned multiple times already, most vendors aren’t familiar with the forms. And even if they are, they may not always follow the rules.

For example, before reading this blog, you may have heard you could combine receipts on one form. But most people don’t know that you can only combine the receipts if the purchases are made within the same month!

If you take the risk of listening to the vendor over the VAT Office, you may end up paying those taxes in the end.

Using the NF2 form incorrectly

The NF2 form has a few more rules than the NF1.

First, if you want to make a purchase that’s at least €2500, get a quote or cost estimate in writing first. Do not pay the vendor or sign anything until you’ve taken the quote to the VAT office!

The VAT office has to approve the quote before giving you an NF2 form. If you make the purchase or sign a contract before getting approval from the VAT office, you won’t get the VAT form.

Home renovations and repairs

Most people won’t need to pay for renovations because they’ll be renting, and the landlord is responsible for that.

But if you decide you want to pay for some minor repairs to your home, review AER 215-6 sections 12-43 first. After that, you should also check with the VAT office to confirm!

Buying heating oil

Some homes require heating oil, which is a valid use of the VAT form. But it can be tricky because you don’t know how much oil is pumped into your tank.

Not sure what to expect from your new house? Check out our guide to housing in Germany!

Talk to the vendor about the price per liter (excluding VAT) to make sure your purchase stays under the NF1 form limit of €2499.99. And be sure to leave a buffer for any delivery charges!

Group purchases

The VAT office doesn’t issue forms to groups or businesses. VAT forms can only be used by approved individuals.

Let’s say your FRG is planning a holiday party and you want to buy decorations and food on the German economy. Only one person can use the VAT form for that purchase. How that person gets reimbursed by the FRG is a separate matter!

Utilities and long-term contracts

You can’t use VAT forms for recurring bills from a single vendor. Even if the vendor asks you for the form, it’s not allowed!

While the amount on your monthly cell phone bill may change from month to month, your contract exceeds a 1-month period. Therefore, the “purchase” doesn’t qualify for either the NF1 or NF2 form.

There is, however, a separate program to help you save money on utilities.

Utility Tax Avoidance Program (UTAP)

As of 2021, the tax on utilities such as gas and electricity vary from 7 to 19%. But because these are long-term contracts, there’s a separate program to be exempt from those taxes: UTAP.

Only services from companies that have a contract with the Tax Relief Office (TRO) qualify for UTAP. So if you want to save money on utilities, don’t set them up without confirming!

If your utilities are billed directly to your landlord, then you’re not authorized to use UTAP. Check with your landlord, and also ask if they can register you with the utility providers.

Before you sign up for the program, you will need:

• a German bank account number (can get from banks on post or a German bank)

• a copy of your lease

• a completed UTAP application

• a valid military ID card (active duty or civilian)

• a copy of your orders

You’ll also need to walk through your home with the housing office and record the meter readings. Once everything is approved, you pay a one-time $99 registration fee. (Trust us – you WANT to pay the $99!)

Ready to Save Money?

Using VAT forms doesn’t require a finance or accounting degree. But it does require a little research and patience.

If you still have questions about how to use VAT forms, visit your local VAT office. They’re happy to answer any questions you have.

And once you have your forms, you’ll save a lot of money while shopping on the economy!

Subscribe to learn more about all your benefits as an American living in Germany, or get prepared for your move with our Ultimate PCS Checklist!

RELATED VIDEOS